It’s a seller’s market for Minnesota small businesses. But Andy Kocemba, who counsels small business sellers, says you can still leave big money on the table. Before putting your business on the market, answer four critical questions — one of which relates to your IT infrastructure.

Andy is the co-owner and CEO of the Minneapolis firm Calhoun Companies, a team of brokers who help small businesses find buyers and negotiate deals. He likes small-business deals because they’re personal.

“It’s real people. It’s not investors dominated by management teams and that type of middle-market game,” Andy says. “It’s intriguing to investigate a small company’s strengths, weaknesses, and guide their owners through the pre-sale preparations.”

Andy Kocemba

Working With Small Businesses

Calhoun Companies has been in operation since 1908. Andy Kocemba and his father Wally have co-owned Calhoun Companies since 2011. Wally had been a longtime employee and taught Andy the business. Now, Andy is the CEO and Wally is the Chairman and CFO.

Their brokers mostly represent small business sellers, listing the businesses for sale, coaching the sellers, assessing potential buyers, and helping negotiate and close the transactions.

Most of their transactions are for businesses worth $500,000 to $5 million, but they also handle smaller and larger sales. The company represents a broad array of small business types, including retailer, manufacturers and professional service providers.

Like Andy, we work primarily with small businesses, and over time, you get to know the hallmarks of a well-run operation. Based on what Andy told us and our own observations, here are top questions you should answer before you decide to put your small business on the market:

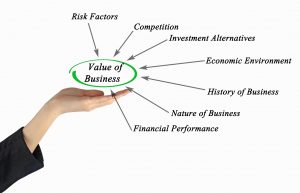

1. What is Your Business REALLY Worth?

You won’t know what your business is really worth until the market tells you. That is, until you’ve accepted a valid offer. First, however, you need to set a baseline value estimate, which does two things, according to Andy:

1. It helps you decide whether you’re truly ready to sell. Will a sale price close to this baseline estimate give you what you need to retire or move on to something else? Or do you simply have to adjust your expectations for your post-sale lifestyle?

2. A detailed valuation can show you areas where you can improve your business to increase your asking price.

The first thing Calhoun brokers offer prospective sellers is a thorough, professional (and free!) valuation.

There’s nothing wrong with starting by using an online calculator yourself. The number you get may actually be a decent ballpark figure — or it may be way out in left field. Be sure. An expert valuation is critical if you’re seriously considering putting your business on the market.

2. What Are the Marketplace Conditions for Your Industry or Niche?

Prospective buyers will be looking at the near-future and long-range market forecast for your business. Of course, depending on your industry or niche, a reliable forecast may not be possible. But the forecast will affect the value of your business to some degree.

Keep one simple economic condition in mind, says Andy: Regardless of the overall market’s ups and downs, there are more buyers looking for good businesses to come to market than there are good businesses for sale.

“A good small business coming onto the market for sale is in control,” he says. “That gives you a lot of power — and it can also end up with you leaving chips on the table if you haven’t planned properly for a sale.”

3. Is Your Business’s Infrastructure Ready for Inspection?

Obviously, the most important factor in a small business’s value to buyers is its earnings. Valuations generally start with a multiple of the business’s average annual profit. However, Andy says the final price your business can command also depends on what’s under the hood.

Take a close look at these elements of your small business’s infrastructure:

- Buildings and equipment: Can you present recent professional assessments of their value and condition? Are necessary licenses and permits up to date?

- Records: Is your bookkeeping up to professional standards? Could a knowledgeable person from outside your business look at your records and understand your profit/loss statement, including your payroll, billing, taxes, expenses, etc.?

- IT systems and gear: Prospective buyers for most types of businesses today will need to know exactly which computer hardware and software products would be included in the sale. It may be critical for them to know what it will take to integrate their system with yours.

We’ll unpack the IT element of infrastructure a bit more later in this article, because it’s a good example of how sellers can leave money on the table.

4. Can You Go on Vacation?

Ahhh, now we’ve come to the BIG question. Even if an owner will be staying on after the sale to run the small business as an employee, almost every buyer will want to know: Can the business operate without this person?

So ask yourself, when was the last time you were away — completely away — from your business, and it ran well without you? If the answer is “never,” or “I can’t remember,” you’ve got some work to do.

According to Andy, when you put a small business on sale, you’re trying to do two things:

1. Gain the trust of a buyer.

2. Make a strong case that the buyer will be able build the business up from where it is today.

“If you’ve got an owner who runs the business, a spouse who does the books, and a nephew who does the assembly, that’s going to be a tougher sale,” Andy says.

Bring in new people with skills and talents that complement your own, he advises. Train and empower them. That builds the overall value of your operation when it’s time to sell. And until then, heck, you might even get to take a vacation!

In-Depth: Your IT Infrastructure Reflects Your Overall Business

Buyers are on the lookout for anything that will need to be upgraded after the purchase. A leaky roof. An outdated website.

For many small businesses today, IT is a core function. So, the general state of software, PCs, mobile devices, printers, networking gear, etc., comes into play during a sale. More importantly, they can give the buyer a general clue about how well your business has been maintained overall.

Andy is clear that IT isn’t much of a consideration for some small business buyers. But I’ve had clients who needed my help before and after these transactions, and I’ve seen that getting your IT house in order can make a big difference in creating a smooth transition for buyers.

Some buyers will need to integrate legacy systems from both sides, and I’ve been called in many times after a sale to sort this out for the new owners. Getting an IT checkup before a sale can be very useful for both parties, and it’s a show of good faith by the seller.

Involve Your IT Services Partner Early in the Selling Process

If you use an outside IT managed services contractor, be sure to involve that provider early in the process when you’re considering selling your business. You want to present buyers with an organized, updated, and secure IT environment whenever possible.

For example, you should be able to explain how critical data is backed up, and how it is protected from cyber attacks. Buyers may want to confirm they’ll have access to proper credentials, licensing information, and warranty information.

In some cases, it’s best to simply have buyers communicate directly with your IT services firm.

A Strong Vendor/Partner Relationship Adds Value

In addition to a cross-trained, independent staff, a small business’s strong relationships with vendors and strategic third-party partners can signal to buyers that the business is well run.

On the flip side, if your business gets all of its office supplies from a cousin’s store at a “family discount,” and your daughter-in-law who just graduated tech school handles your IT, a buyer will have to factor those extra costs into the offer.

Show buyers you’ve developed strong support from outside your business. The buyer may choose other options after the sale, but your work in developing these relationships over the years should be counted among your business’s advantages.

Can You Achieve This Happy Ending?

Let’s close with this story from Andy about his favorite end to a small business sale:

“I’m sitting at the closing table and on one side is a husband and wife who I’m helping to retire and achieve their dreams.

“And on the other side of the table is another entrepreneur who has always dreamed of owning a business. After working in a corporate job for many years, he finally said, ‘You know what? I need to do what I’ve always wanted to do.’

“I’m helping people achieve their dreams on both sides of the table. That’s one thing I love about what we do here.”

These kinds of win-win situations are what a good business sale is all about. And a solid IT infrastructure, along with the other key elements Andy’s mentioned here, are what can make it happen.

If you’re interested in contacting Andy for information about selling your business, click here. And if you’d like help on assessing your own IT infrastructure, contact TechGen as well!